- Cash Contributions

- Appreciated Securities

- Real Estate

- Privately Held Interests

- IPO Stock

- Restricted Stock

- Life Insurance

Contribute Privately Held Business Interests

(C-Corps, S-Corps, LLCs, LPs)

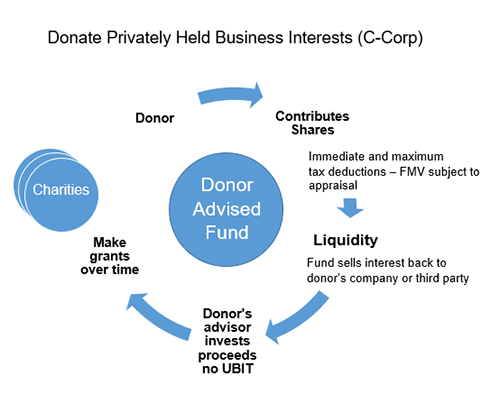

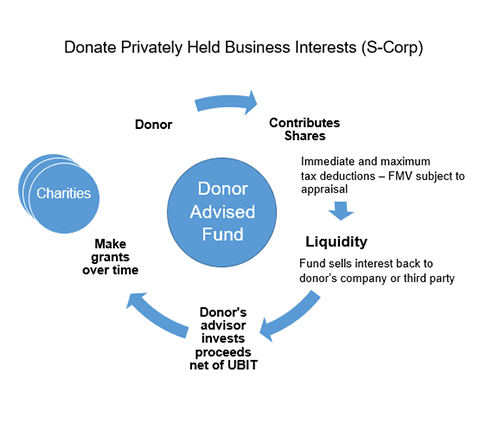

Do you have appreciated assets in the form of complex—often referred to as “hard-to-value”—illiquid assets (i.e., privately held C-Corp and S-Corp stock, LLC interests, and/or limited partnerships)? These assets offer the opportunity to contribute once while also supporting your favorite charities over time.

These interests often have a low cost basis and a significant current market value, resulting in a potentially large capital gains tax when sold. By contributing a portion of these highly appreciated, privately held business interests to your donor-advised fund, you can take a full and fair market value income tax deduction for the contribution, while avoiding capital gains taxes on the appreciated values.

In comparison, contributions of business interests to a private foundation would be deductible at a cost basis—which, for the donor, is typically low.

Considerations Include:

If you are contemplating a contribution of illiquid assets, we strongly recommend contacting us as early in the process as possible. We have extensive hands-on experience in working with professional advisors in the review of a company’s management and governance documents, as well as in coordinating asset transfer and gift acceptance.

We will review ownership of shares in the donor-advised fund to avoid excess business holding regulations. Shareholdings in the donor-advised fund that exceed IRS limits must be sold within 5 years of the contribution date.

The IRS treats contributions of S-Corp shares differently to contributions of C-Corp shares. In both cases, the donor will receive an income deduction for the fair market value of shares contributed and avoid capital gains tax on appreciated values.

On contributions of S-Corp, however, the charity takes on the donor’s cost basis and must pay a tax (unrelated business income tax) on the appreciated values when the shares are liquidated. This reduces the value of assets in the donor-advised fund. We have experience with creative strategies that can minimize the tax bite of gifts of appreciated S-Corp shares.

Please call us for more information.

Special Considerations:

Note: You must not have proceeded to the point at which the IRS would consider it a prearranged sale. Such scenarios could potentially result in a tax liability on the appreciated values.

For gifts of privately held securities and interests, you must obtain a qualified appraisal of the shares in order to substantiate the charitable deduction claimed. Appraisals depend on the facts and circumstances at the time of the contribution, and may be discounted for lack of marketability and/or lack of control.

The IRS will not allow contributions of indebted interests. Please call us to discuss your options.

Note: This information is provided for informational purposes only, and should not be interpreted as legal and/or tax advice. Donors should always consult their legal and tax advisors regarding their specific situations.

Questions?

- Call toll-free 800.810.0366

- ask@iGiftFund.org

- What is a Donor-Advised Fund