Contribute Life Insurance

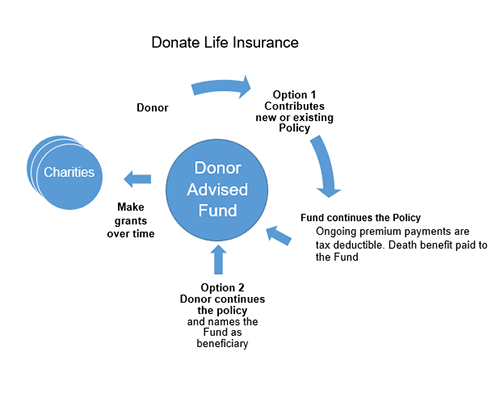

Donors can use a variety of creative contribution strategies by leveraging life insurance to fund an charitable estate for their donor-advised fund.

Donors may gift a life insurance policy to the iGiftFund.

If the gifted policy is paid up, the value is based on the replacement cost of the policy as reported by the insurance company.

If the gifted policy requires the continuation of premium payments, the value is based on the policy’s interpolated reserve as reported by the insurance company. If the donor contributes future premium payments, iGiftFund will acknowledge to the donor the entire amount of the additional premium as a charitable gift in the year that it’s made.

Donors may recommend that iGiftFund purchase life insurance on the life of the donor using other liquid assets in the donor’s fund.

In both strategies, iGiftFund must be named as the beneficiary and irrevocable owner of an insurance policy before a life insurance policy can be recorded as a gift.

Donors can name iGiftFund as the beneficiary or contingent beneficiary of their life insurance policies. Since the donor retains control of the policy, no deduction is available until the gift is irrevocable.

Donors may assign dividends on life insurance policies to their fund.

Subject to a face-value minimum of $1 million or more, donors may designate their fund as the beneficiary of a charitable insurance rider, typically at no additional cost to the insured. For example, the rider may pay between 1 and 2% of the face value to the donor’s donor-advised fund at death.

Questions?

- Call toll-free 800.810.0366

- ask@iGiftFund.org

- What is a Donor-Advised Fund