Contribute IPO Stock

If you’re contemplating a contribution of IPO shares, we strongly recommend contacting us early in the process. We will work with your professional advisors in the review of IPO documents, and to coordinate the asset transfer and gift acceptance.

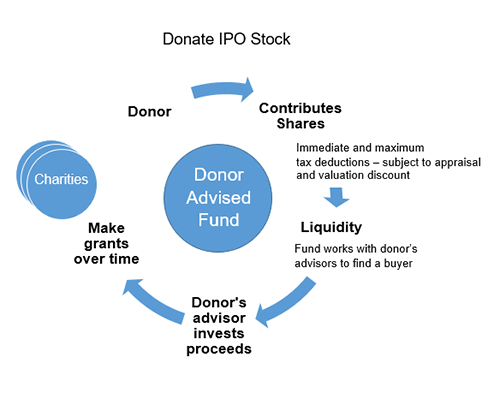

Donors considering a contribution of IPO stock may also face long-term capital gains tax on the sale of highly appreciated shares after an initial public offering. A donor may realize a much more favorable income tax result (leaving more available for charitable giving) by contributing a portion of their IPO shares (either during or after the lock-up period) to their donor-advised fund.

If a donor sells the stock first and then donates the cash proceeds to charity, the donor may be subject to capital gains taxes on the proceeds from the sale of the stock. Conversely, if a donor contributes the IPO shares directly to a donor-advised fund, the donor can usually deduct the fair market value of the donation without realizing any capital gain.

Considerations Include:

- Timing of contribution

- Coordination with your advisors

- Coordination with the company’s attorneys

- Timing for liquidation

- Special considerations for liquidation

- Excess business holding regulations for shares held in the donor-advised fund that exceed IRS limits

Note: This information is provided for informational purposes only, and should not be interpreted as legal and/or tax advice. Donors should always consult their legal and tax advisors regarding their specific situations.

Questions?

- Call toll-free 800.810.0366

- ask@iGiftFund.org

- What is a Donor-Advised Fund