- Cash Contributions

- Appreciated Securities

- Real Estate

- Privately Held Interests

- IPO Stock

- Restricted Stock

- Life Insurance

Contribute Appreciated Securities

Donate publicly traded appreciated securities (in the form of publicly traded stock, ETFs, closely held stock, or mutual funds). These assets are among the most tax-advantageous items to donate to charity.

Contributing such assets may enable the donor to enjoy the double benefit of an immediate income tax deduction (the highest available) and avoid capital gains tax on appreciated values.

Giving appreciated securities makes sense because:

- The donor may wish to support more than one charity from the proceeds.

- There are year-end challenges in splitting a position among respective charities.

- The donor may want to support a charity over time instead of in one lump sum.

- There may be special instructions regarding timing and liquidation.

- Stock can be contributed and held in-kind.

Donate Appreciated Securities

A Tax-Wise Planning Opportunity

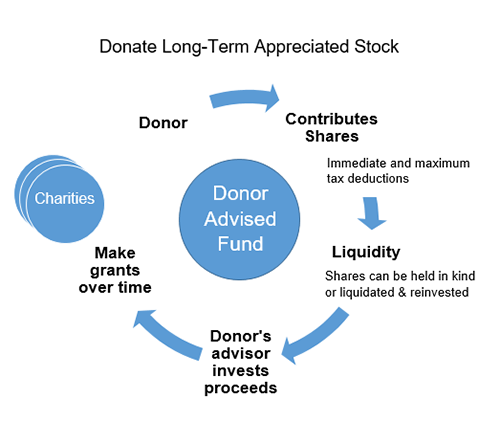

Investors who are considering current-year charitable contributions and who are also facing long-term capital gains taxes on appreciated stock (one year minimum) can realize a much more favorable tax benefit and charitable impact by contributing appreciated stock to a donor-advised fund.

If a donor sells the stock first and then donates the cash proceeds, the donor may be subject to capital gains taxes on the proceeds from the sale of the stock. Conversely, if a donor contributes appreciated stock (held for more than one year) directly into a donor-advised fund, the donor is typically able to deduct the fair market value of the donation without realizing any capital gain. In comparison, contributions of assets (other than publicly traded securities) to a private foundation would generally be deducted at a cost basis.

iGiftFund can accept restricted stock, including stock subject to a lock-up agreement. However, such restrictions may impact the valuation of the stock for charitable deduction purposes.

Donors should not enter into any arrangement that would legally compel iGiftFund to dispose of the stock upon receipt. This kind of “pre-arranged sale” could reduce or eliminate the tax benefits to the donor.

Donors may have special considerations with appreciated securities. Please contact us directly to discuss these types of special situations in advance.

Note: This information is not intended to be a substitute for individualized tax, legal, or investment planning advice. Wherever specific advice is necessary or appropriate, donors should consult with a qualified tax advisor or CPA.

Questions?

- Call toll-free 800.810.0366

- ask@iGiftFund.org

- What is a Donor-Advised Fund