Contribute Restricted Stock

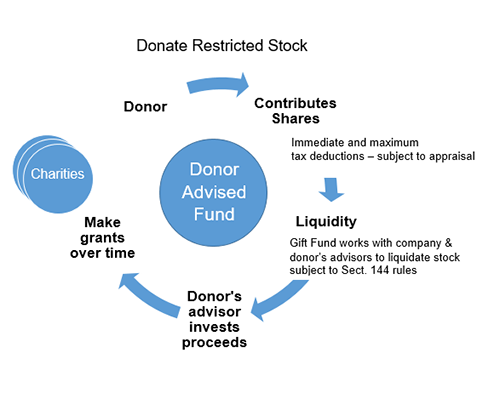

iGiftFund will work with your professional advisors to consider a number of complex issues regarding in-kind gifts of restricted stock, including the timing of the contribution, the valuation of the stock, and the subsequent limitations to dispose of the stock once in your donor-advised fund. These issues, particularly the timing issue, may become more relevant to donors and charities alike as the year end approaches.

You can take a full and fair market value income tax deduction for the contribution while avoiding capital gains taxes on the appreciated values. In comparison, if those shares were contributed to a private foundation, your deduction would be the cost basis.

If you’re contemplating a contribution of restricted shares, we strongly recommend contacting us as early in the process as possible.

Once we accept the shares, we can rely on the “safe-harbor” provisions of Rule 144 of the Securities Act, and resell the shares at the appropriate time within your donor-advised fund.

Restricted stock can be a tax-wise asset contribution to a donor-advised fund. Many executives have concentrated holdings of restricted stock in their companies. These holdings may have a low cost basis and significant current market value that will result in large capital gains taxes when sold.

By donating a portion of their appreciated restricted stock (held for more than one year) to a donor-advised fund, donors are able to enjoy a current-year tax deduction and potentially eliminate capital gains tax liability on the sale of the asset, leaving more available for their charitable giving. Conversely, contributions of similar assets to a private foundation would generally be deductible at the lower of the cost basis or market value.

Considerations Include:

If the executive is subject to Rule 144’s public sale restrictions, and/or is considered a “control person” in the company, the company’s general counsel must get permission to transfer the shares. iGiftFund can then work with the donor to sell the shares at acceptable times.

Note: This information is provided for informational purposes only, and should not be interpreted as legal and/or tax advice. Donors should always consult their legal and tax advisors regarding their specific situations.

Questions?

- Call toll-free 800.810.0366

- ask@iGiftFund.org

- What is a Donor-Advised Fund