Phil Tobin – Founder/Chairman of iGiftFund

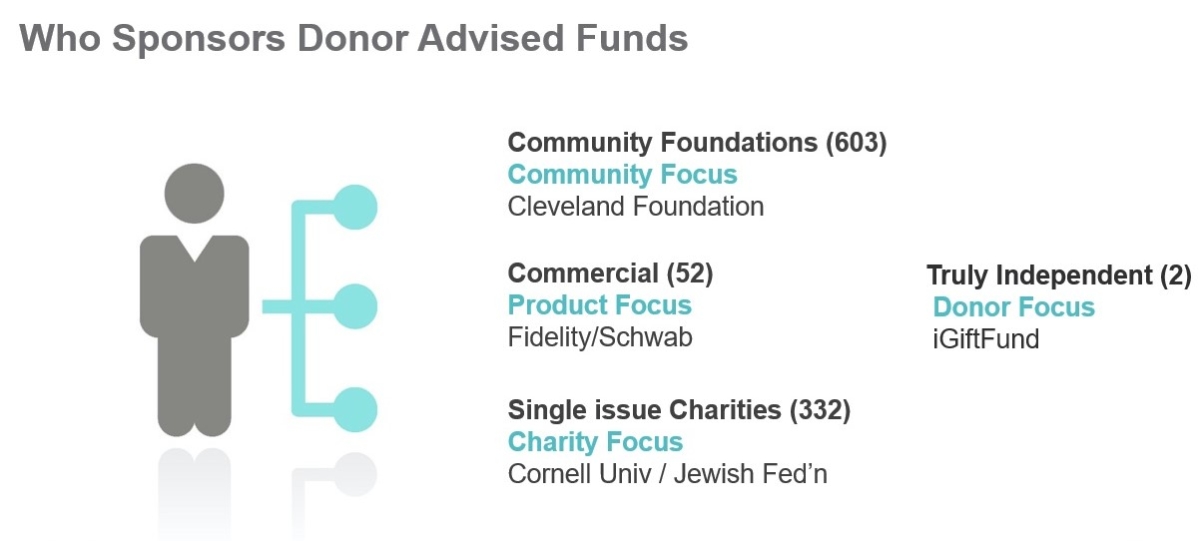

Today there are nearly 1,000 public charities that sponsor DAFs, the fastest-growing and most active philanthropic vehicle in America…but not all sponsor programs are alike.

With so many sponsors to pick from, the task of recommending a sponsor as steward of your client’s philanthropic legacy is not an easy one. Here is a summary of the types of organizations that sponsor DAFs and a checklist of things to look for in recommending a DAF sponsor as steward for your client. iGiftFund’s solution follow in italics.

Things to Look for in Selecting a DAF Sponsor

- Sponsor Focus

Note 1: NPT 2019 DAF Report

- Independence – Is the sponsor a charitable entity of a product-based, for-profit financial institution, a community foundation or another faith-based/mission-based charity? Does the sponsor promote a product or mission-related agenda?

iGiftFund: With no pools, no products and no services to sell and no philanthropic agenda, iGiftFund’s focus is entirely on the philanthropic interests of the donor.

- The Donor Experience – Will you and your client receive the level of philanthropic and administrative support you both need? Will you have ready access to the principals and key employees? Will communication be through call centers and online portals? Does the charitable entity of the sponsor have employees? What is their level of experience in addressing the unique needs of your clients?

iGiftFund: Does not operate a call center. You and your clients have ready access to iGiftFund’s principals and staff with the longest experience in the donor advised funds industry.

- Affordability – Most national sponsors charge an annual administrative fee according to a tiered fee schedule. For example: an initial % on the first $500,000 of fund balance, a reduced fee on the next $500,000 of fund balance, and so on. The fee charged by national sponsors (usually expressed as a basis point or bps) can range from 60 bps (0.0060) on the lower end of the scale up to 95 bps (0.0095). The tiered Administrative fee schedule of community foundations and single-issue sponsors typically start at 100 bps (0.0100) or more and many sponsors charge a minimum annual fee that ranges from $100 to $500.

iGiftFund has as the lowest Administrative fees in the industry. For example, iGiftFund’s administrative fee schedule starts at 45 bps (0.0045) on the first $500,000 of the fund balance; 22.5 bps (0.00225) on the next $500,000 of the fund balance; and so on. Your clients will save 25% to 50% when compared to the fee schedule of other sponsors. iGiftFund’s minimum annual fee is $600.

- Investment choice – Most sponsors offer a variety of proprietary investment pools. Some commercial sponsors will allow the donor’s financial advisor (typically RIAs only) to manage investments in the donor’s DAF with a fund balance in excess of $250,000, some for balances over $1 million, subject to investment policies of the sponsor. Most sponsors limit the donor’s choice of custodian and most will immediately liquidate contributed assets for reinvestment in pools.

iGiftFund: Does not manage investments. As broker or in a managed account relationship, you manage the investments in your client’s DAF in open architecture, at all fund size levels, on your familiar platform. Assets types can be held in kind. You keep your relationship as your client’s trusted advisor.

- Fund options – Most national sponsors focus on donor advised funds as a primary donor fund solution.

iGiftFund: Organized as a national community foundation, iGiftFund offers a full range of donor fund options, in addition to DAFs, that can be tailored to the donor’s unique needs including: designated funds, field-of-interest funds, unrestricted funds, scholarship funds, agency endowment funds, etc. Certain of these latter funds are not considered donor advised funds and as such are eligible to receive Qualified Charitable Distributions (QCD) at age 70-1/2 and count towards your clients’ RMDs at age 72.

- Systems –How old is the sponsor’s system and can it support a level of service your client will need? Is their website easy to work with? Can statements and grant recommendations be accessed on line or by phone? Is knowledgeable staff available to provide guidance?

iGiftFund: Partners with the most advanced donor system in the industry, Stellar Technologies Solutions, LLC to provide a level of systems support equal to or better than the leaders in the industry.

Donor advised funds offer a simple, tax-smart and meaningful way for your clients to:

- support their charitable interests and to create their philanthropic legacy;

- and for you to add value to your relationship as your clients’ trusted advisor and to earn the loyalty of the next generation.

Since all donor advised fund sponsors differ, do your homework, before recommending sponsor’s solution that best meets your client’s unique goals and objectives. In the end, it’s the donor experience that makes the difference.

Learn more about iGiftFund’s unique solutions and how we can work with you.

Call us at 800.810.0366 or email ask@igfitfund.org today.

This information contained in this article is intended solely for educational purposes.

The content is not intended, and shall not be construed as professional advice (or a substitution for) including but not limited to legal, financial, tax or any other professional interpretation.