Maximize Your Client’s Charitable Impact with the Best Donor Advised Fund Fit

Donor Advised Funds (DAFs) are a tax-smart, flexible way to manage charitable giving, with over $200 billion in assets nationwide in 2025 (NPT 2024 DAF Report).

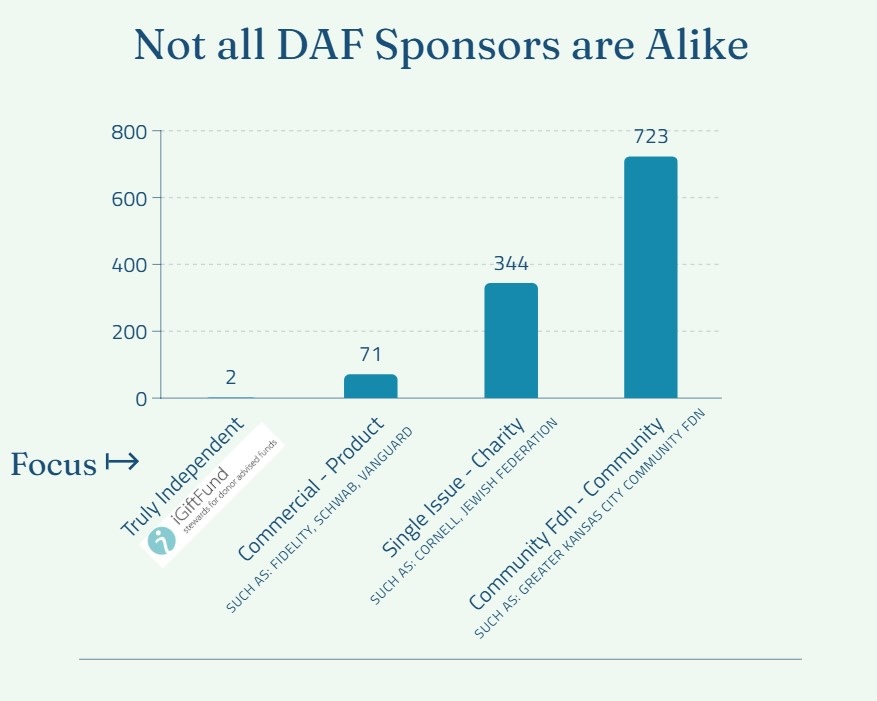

But with more than 1,100 DAF sponsors—from national powerhouses to local foundations—choosing the right one can shape your client’s experience, from investment growth to grantmaking ease.

Here’s a clear guide to the key factors to consider when selecting a DAF sponsor, ensuring your client’s charitable goals are met with precision and impact.

1. Values and Reputation: Do They Align with Your Client?

A DAF sponsor’s mission and values should resonate with your client’s priorities. Some sponsors emphasize faith-based giving, social justice, or environmental causes, while others focus on operational excellence.

Research their leadership, track record, and business model to ensure they align with your client’s vision.

A sponsor with a strong reputation ensures your client’s funds are stewarded responsibly. Choose one whose values and priorities match your client’s goals for maximum impact.

Data Source: 2024 NPT Report

iGiftFund Advantage: With no products or services to sell, iGiftFund focuses solely on your client’s philanthropic vision, delivering impartial, donor-centered service.

2. Investment Choices: Flexibility to Grow Charitable Dollars

A DAF isn’t just a giving tool—it’s a vehicle to grow charitable assets which, in turn, supports giving. Sponsors vary widely in investment options. Some offer limited, pre-set portfolios (e.g., bonds or stock market funds), while others allow customization, including alternative assets like real estate or private equity.

As a financial advisor, retaining and growing your client’s assets under management (AUM) is critical. Look for a sponsor that offers open-architecture investing, letting you manage assets at any custodian without proprietary pools or products.

iGiftFund Advantage: iGiftFund empowers advisors to retain and grow AUM across all account sizes, using any custodian in an open-architecture model—no proprietary products or pools.

3. Personalized Expertise: Guidance & Collaboration

The right DAF sponsor acts as a true partner, offering collaboration and customized support. Some sponsors rely on apps or call centers, which may not suit advisors seeking collaborative support.

Decide whether you want a platform for quick transactions or a partner who strategizes with you to execute your client’s vision.

iGiftFund Advantage: iGiftFund delivers personalized, live support—no call centers. Our founder pioneered the first national DAF program, bringing three decades of industry expertise to every conversation, ensuring advisors and clients get strategic, hands-on guidance.

4. Fee Structures: Maximize Giving Power

Transparent fees ensure more of your client’s funds support their chosen causes. Most DAF sponsors charge annual administrative fees (0.5%–1% of the fund’s balance) plus investment management fees, with some adding grant transaction costs or minimum balance penalties. Compare fee structures to find a sponsor that balances cost with robust services.

iGiftFund Advantage: iGiftFund offers the industry’s lowest administrative fees—25% less than competitors—freeing up more funds for your client’s charitable goals without sacrificing service quality.

5. Grantmaking: Freedom to Support What Matters

A DAF sponsor’s core purpose is to review and process grant requests to the charities that your clients have chosen – but sponsors set different rules: Some process grants to any IRS-approved nonprofit quickly, while others impose minimum grant amounts, restrict certain causes or issue grant payments only at certain intervals.

Ask about grant processing speed and flexibility to ensure the sponsor aligns with your client’s giving style.

iGiftFund Advantage: iGiftFund streamlines grantmaking to IRS-approved nonprofits, with efficient processing to support your client’s charitable priorities, backed by advisor-focused service.

6. Minimums and Accessibility: Who Can Participate?

DAF sponsors often require a minimum initial contribution to open an account, with ongoing minimums for additional gifts. These thresholds vary, so choose a sponsor that matches your client’s financial capacity and giving habits. For advisors, confirm the sponsor allows you to retain fund management across all account sizes.

iGiftFund Advantage: iGiftFund lets advisors retain and manage funds in open architecture, using any custodian, for all account sizes—ensuring flexibility and control.

7. Beyond DAFs: Tailored Fund Solutions

While most sponsors focus solely on DAFs, some offer additional solutions such as a Donor Restricted Fund to meet unique client needs. These options allow advisors to craft bespoke charitable strategies, enhancing client relationships. Consider sponsors that offer:

- Designated Funds: Support specific charities.

- Endowments: Create lasting legacies.

- Field of Interest Funds: Focus on broad causes.

- Scholarships: Fund education.

Keep in mind that while Qualified Charitable Distributions (QCDs) cannot go to a DAF, they can go to a Donor Restricted Fund and can satisfy Required Minimum Distributions (RMD).

iGiftFund Advantage: iGiftFund provides a full suite of Donor Restricted Fund (DRF) solutions beyond DAFs, tailored to your client’s goals, empowering advisors to deliver comprehensive charitable planning. DRFs qualify for QCDs. You can manage your client’s DRFs.

8. Final Takeaway: Choose a DAF Sponsor That Fits Your Client

With DAFs over $200 billion in 2025, the right DAF sponsor supports your client’s charitable impact. Compare values, investment flexibility, fees, support, and fund options to find a partner that aligns with your client’s goals and your advisory practice.

iGiftFund Advantage: iGiftFund combines low fees, personalized service, flexibility and multiple fund solutions, empowering advisors to maximize client impact.

This information contained in this article is intended solely for educational purposes.

The content is not intended, and shall not be construed as professional advice (or a substitution for) including but not limited to legal, financial, tax or any other professional interpretation.