Determining the goals of your One Page Legacy Plan is an important final step. Just as important is taking advantage of the right tools – like donor advised funds – to meet those goals effectively, and to ensure your legacy is an enduring one.

By Phil Tobin

This article is the last in a series taken from The One Page Legacy Plan by Phil Tobin, a free downloadable eBook from iGiftFund. In this piece, we’ll walk through establishing the goals of your legacy plan, and we’ll detail some useful philanthropical tools you can use to meet them.

NOTE: Some readers of this series may not have received the One Page Legacy Plan Worksheet that should have been included with the first article in this series. For your convenience, both the One Page Legacy Plan and the One Page Legacy Plan Worksheet are included at the end of this article.

All that is left to complete your One Page Legacy Plan is to establish some concrete goals and to determine the right strategies to complete them. Like every other step in this process, I recommend working collaborative with the members of your family and your trusted financial advisors to determine what works best for you.

First, your legacy plan goals can take the form of short statements that summarize what we intend to do to successfully create, preserve, and pass on our legacy for future generations.

Here are some examples of goals or objectives for your legacy plan:

- Develop a Legacy Plan that supports our family mission

- Provide my spouse with financial security and control over assets

- Teach children and grandchildren to understand the “Why” of family legacy wealth

- Improve state of family relationships

- Provide managed access to children’s financial assets

- Optimize tax benefits

- Provide managed access to children’s inherited wealth

Next, you’ll have to determine the right strategies to reach these goals. These can also take the form of short statements that summarize what we have to do as a family to successfully reach the goals of your legacy plan.

It’s important to remember that a successfully executed legacy plan is not achieved by accident. It is the result of thoughtfully crafted strategies that provide a roadmap to success. Here are some examples of strategies used to reach the family’s goals:

- Engage a team of trusted financial/legal/accounting/philanthropic advisors

- Develop a plan to educate the children/grandchildren on the “Why?” of family wealth

- Revise and update investment strategy

- Develop tax wise strategy for funding your legacy plan

- Revise and update wills/trusts

- Revise and update advanced directives

- Revise and update beneficiary designations; confirm with trustees

- Engage children/grandchildren in age-appropriate philanthropic activities to teach

family values in an individual and shared environment

These strategies will appear in the “How? Strategies to Accomplish Goals of Your Legacy Plan” section on your One Page Legacy Plan. Finally, you’ll need to determine where the assets of your legacy will come from, and where they will go in the successful implementation of your plan. These can live in the “Where? Beneficiaries of Your Family Legacy Wealth” section of the One Page Legacy Plan.

An effective tool to reach your goals: The Donor Advised Fund. Earlier in this series, we discussed the important role that family philanthropy can play in successful legacy wealth transfer. It’s useful in helping to teach your heirs about financial responsibility and about being good stewards of wealth. And to those ends, throughout my years of experience helping families do this, I’ve found Donor Advised Funds (DAFs) to be one of the most effective and powerful tools for family philanthropy.

A DAF is a charitable giving account sponsored by a public charity, and can be a powerful giving vehicle and the key to making your legacy plan a successful one. They offer you a way to retain greater control over your philanthropic assets. You can create a donor fund with a contribution to the sponsoring charity and receive immediate and maximum tax benefits. You can also recommend grants over time to any IRS-qualified public charity. You can put a variety of assets in the fund including cash, securities, or other financial instruments. While you give up ownership of these assets, you retain advisory privileges over how the account is invested and how money is charitably distributed.

Who Sponsors Donor Advised Funds?

Importantly, not all DAFs are alike. Some DAFs are more restrictive than others in terms of naming the foundation; the types of assets that donors can contribute; the types of assets the sponsor can hold; the role of the donor’s financial advisors; investment choice; charities that can be supported; and the number of generations that can succeed as advisors. Here is a summary of DAF sponsors:

Commercial Programs (52). Commercial programs include sponsors like Fidelity Charitable, Schwab Charitable, and Vanguard Charitable which are charitable entities of for-profit financial institutions. These sponsors have a for-profit / product focus.

Community Foundations (603). Donor advised funds got their start with community foundations. iGiftFund is a big fan of community foundations because they understand and focus on the needs of the local community.

Single-issue Charities (332). Examples include the National Christian Foundation, Cornell, Rotary, and Jewish Federations. These sponsors focus on the needs of their charitable mission.

Independent Charities (2). iGiftFund offers a conflict-free platform with no hidden or unspoken agenda (investment, programmatic, geographic, religious, investment management, custodial, or succession) for charitable giving. This enables us to focus entirely on what the donor wants to accomplish while engaging the donor’s trusted financial advisor.

In 1999, we pioneered the idea for a “national, truly independent, advisor-managed” DAF program. Here at iGiftFund, we are able to offer flexibility that others can’t because we’re completely independent. With us you can:

- Enjoy the best available tax benefits. You will receive an immediate and maximum income

tax benefits. - Contribute a wide variety of asset types. You can contribute cash, marketable securities, closely-held securities, real estate, life insurance agricultural assets and many others.

- Recommend investments. You can recommend an investment strategy or request that we

use your trusted financial advisor. - Recommend grants. You and your family can recommend grants to your favorite charities

on your own timetable, in your fund’s name or in full anonymity. - Recommend who will succeed you as fund advisor. You can appoint successors or tailor

your fund so that it goes on in perpetuity.

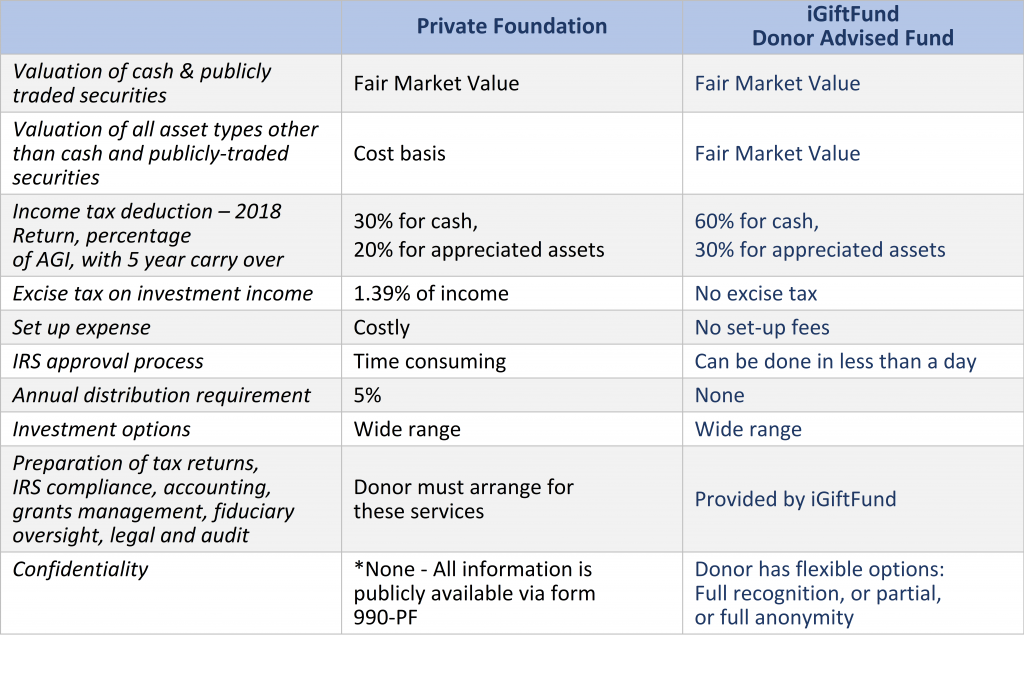

DAFs versus Private Foundations. The two most popular family foundation alternatives are private foundations and DAFs. DAFs have become the fastest growing family foundation alternative – here are

a few important distinctions between the two methods:

*Private foundations provide little confidentiality. For example, anyone with a computer can access Guidestar (www.guidestar.org) to gain information on any private foundation, including a scanned version of its 990-PF, including balance sheet detail (including investment holdings,

*Private foundations provide little confidentiality. For example, anyone with a computer can access Guidestar (www.guidestar.org) to gain information on any private foundation, including a scanned version of its 990-PF, including balance sheet detail (including investment holdings,

a listing of directors (including contact information), every grant that is made (organization name and amount), and detail of administrative

and investment management expenses.

Establishing a DAF. The process of setting up a DAF is relatively simple. You and your family can name it after your family or even name it in someone’s memory as a way to remember a loved one. Once it is funded, you can start recommending grants. Your fund will provide you with many opportunities for family involvement, such as building a bridge for families who are geographically dispersed, providing a forum for intergenerational communication, and helping you to establish your family’s purpose and common bond.

One of our donors used her fund to inspire philanthropy and instill values into the lives of her grandchildren in a super fun way. Every June, she would arrange a family meeting with children and grandchildren. Each grandchild (age 8 and above) would be allocated an amount to give to a charity that the child would research and select to support. In November, when it was time to reveal their choice to the family, the grandchildren would do it in a game of charades where the grandchildren had to decipher the charity chosen. The grandmother was imparting values to the grandchildren and entire family was have fun it.

A DAF can provide you endless opportunities to educate your heirs and build a successful legacy plan that is unique, personal, and profoundly meaningful. I hope this series has been informative and helpful. For more information about establishing a DAF or creating your own One Page Legacy Plan, visit www.iGiftFund.com.

Phil Tobin is Chairman and President of iGiftFund.

This information contained in this article is intended solely for educational purposes.

The content is not intended, and shall not be construed as professional advice (or a substitution for) including but not limited to legal, financial, tax or any other professional interpretation.